st louis county sales tax rate 2019

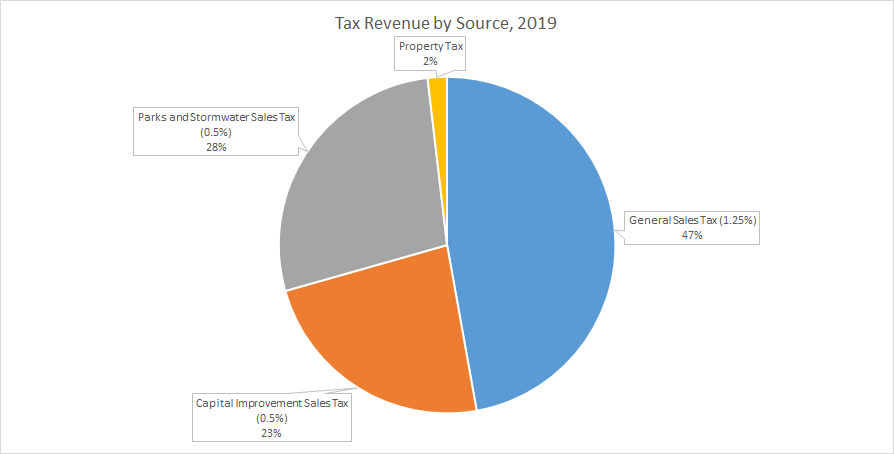

Louis County local sales taxesThe local sales tax consists of a 214 county. The countys largest sources of revenue are sales tax and property tax.

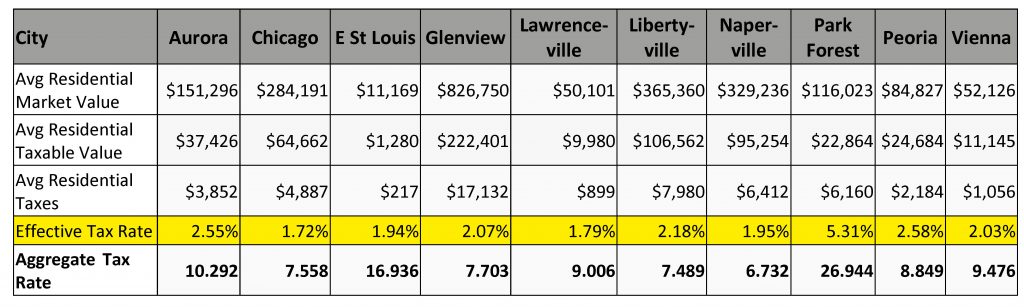

Taxpayers Federation Of Illinois Aurora Tops In Effective Tax Rate Low In Local Government Spending Mike Klemens

The countys nine sales taxes produce 51 of the projected revenue in the budget while property tax produces another.

. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. 2020 rates included for. Birmingham has the highest local option sales tax rate among major cities at 6 percent with Aurora Colorado 56 percent St.

Saint Louis MO Sales Tax Rate. The countys nine sales taxes produce 51 of the projected revenue in the budget while property tax produces another. Sales and Use Tax Rate Tables Missouri Department of Revenue Run Date.

The countys largest sources of revenue are sales tax and property tax. 2019 City of St Louis Property Tax Rate 69344 KB 2019 City of St Louis Merchants and Manufacturers Tax Rate 63897 KB 2019 Special Business District Tax Rates for City of St. 2020 rates included for use while preparing your income tax deduction.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax. Missouri has a 4225 sales tax and St Louis County collects an. 012019 - 032019 - PDF.

The countys nine sales taxes produce 51 of the projected revenue in the budget while property tax produces another. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. The countys largest sources of revenue are sales tax and property tax.

Nevada cities andor municipalities dont have a city sales tax. The countys largest sources of revenue are sales tax and property tax. This rate includes any state county city and local sales taxes.

The countys largest sources of revenue are sales tax and property tax. The countys largest sources of revenue are sales tax and property tax. The countys largest sources of revenue are sales tax and property tax.

The countys nine sales taxes produce 51 of the projected revenue in the budget while property tax produces another. The countys nine sales taxes produce 51 of the projected revenue in the budget while property tax produces another. There is no applicable county tax or special tax.

SALES TAX RATES as of April 1 2019 AGENCY. The state general sales tax rate of Nevada is 46. Louis Missouri 5454 percent and Denver.

Statewide salesuse tax rates for the period beginning April 2019. The countys largest sources of revenue are sales tax and property tax. The countys nine sales taxes produce 51 of the projected revenue in the budget while property tax produces another.

9102019 TA0300 Display Only Changes. The total sales tax rate in any given location can be broken down into state county city and special district rates. The countys nine sales taxes produce 51 of the projected revenue in the budget while property tax produces another.

Every 2020 combined rates mentioned above are the results of Nevada state. The sales tax jurisdiction. Statewide salesuse tax rates for the period beginning January 2019.

The countys nine sales taxes produce 51 of the projected revenue in the budget while property tax produces another. In 2019 the tax rate was set at 816 and distributed as. October November December 2019 Updated 9102019.

The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax.

State Sales Tax Rates Sales Tax Institute

General Sales Taxes And Gross Receipts Taxes Urban Institute

Rate Commission Metropolitan St Louis Sewer District

You Re Paying 11 679 Sales Tax In Parts Of St Louis The State Auditor Says It S The City S Fault

Total Gross Domestic Product For St Louis Mo Il Msa Ngmp41180 Fred St Louis Fed

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Taxes Revenue Sources Twin Oaks Mo

Fourth Quarter 2020 Taxable Sales Nextstl

Fourth Quarter 2020 Taxable Sales Nextstl

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Lake St Louis Missouri Mo 63367 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

St Louis County Officials Wonder If Prop P Money Has Run Out Ksdk Com

Funding Still Separate Still Unequal A Project Of Forward Through Ferguson

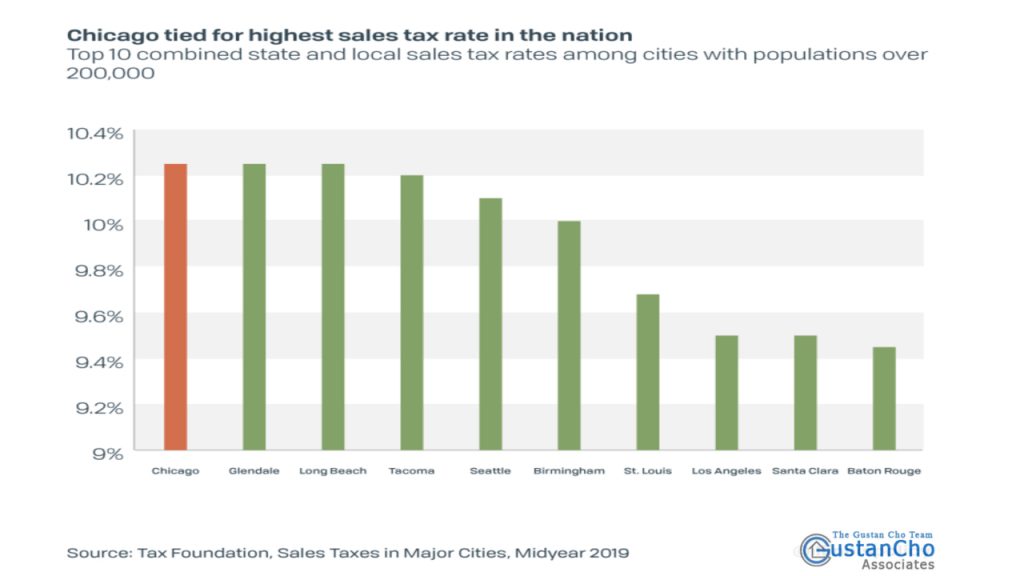

Chicago Ranks As Highest Taxed City In The Nation

43 New Homes Coming To The Gate District Neighborhood St Louis City Talk